personal property tax rate richmond va

The total tax is 5 percent 4 percent state and 1 percent local A seller is subject to a sales tax on gross receipts derived from retail sales or leases of taxable tangible personal property. Questions answered every 9 seconds.

2 days agoRICHMOND Va.

. Business Tangible Personal Property Tax Return Richmond. Richmond VA 23225 804 230-1212.  This information pertains to tax rates for Richmond VA and surrounding Counties.

Call 804 646-7000 or send an email to the Department of Finance. The Local Tax Rates Survey is published by the Department of Taxation as a convenient reference guide to selected local tax rates. Richmond City collects on average 105 of a propertys assessed fair market value as property tax.

Click Here to Pay. Business Tangible Personal Property Tax Return2021 2pdf. Tax rates differ depending on where.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Personal Property Registration Form An ANNUAL. Personal Property taxes are billed annually with a due date of December 5 th.

What is the real estate tax rate for 2021. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Which holds a grand re-opening after 30 million renovation in.

However all that is little comfort to all those car owners who now must pay a lot more in taxes. Personal Property Taxes. Richmond - 370.

WWBT - As Richmond residents see an increase in their Personal Property Tax bills Mayor Levar Stoney is requesting that the due date for the payments be. Parking Violations Online Payment.  This information pertains to tax rates for Richmond VA and surrounding Counties.

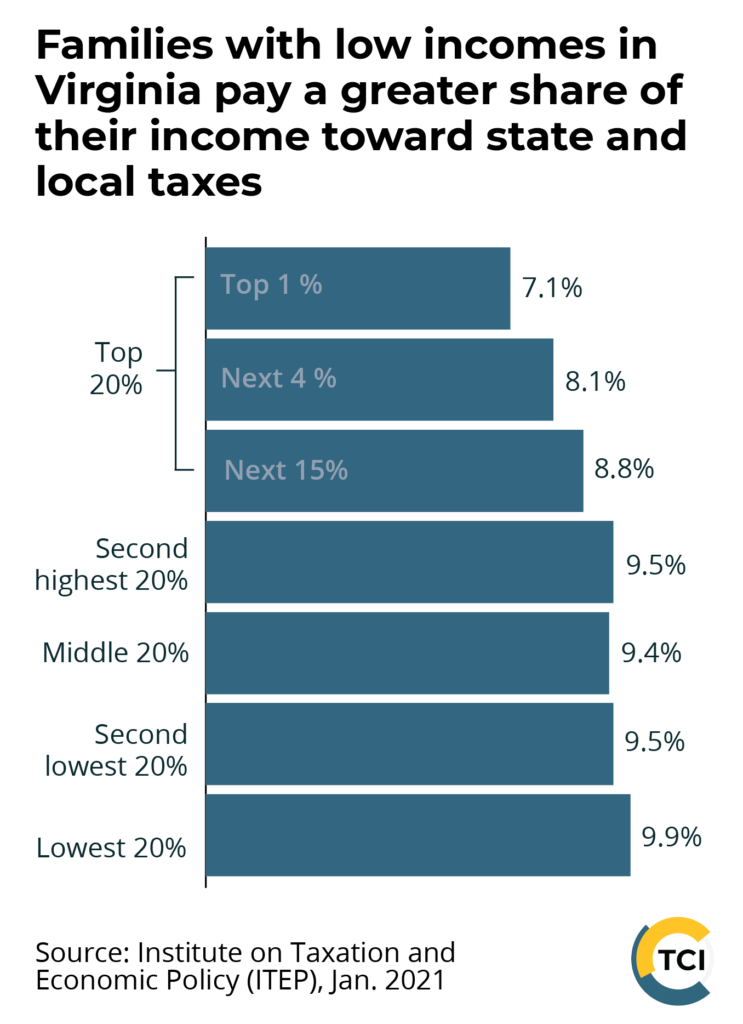

If you are contemplating moving there or just planning to invest in the citys property youll come to know whether the citys property tax rules work for you or youd. Local Taxes Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Local taxes personal property taxes and real estate taxes are local taxes which means theyre.

Personal property taxes are billed annually with a due date of december 5 th. Parking tickets can now be paid online. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in.

Vehicle License Tax Vehicles. The median property tax in Virginia is 186200 per year for a home worth the median value of 25260000. The current personal property tax rate for vehicles in Chesterfield is 360 per 100 of assessed value.

Depending on your vehicles value you may save up to 150 more because the city is freezing the rate. The personal property tax is. Currently the personal property tax rate in the city is 370 per 100 of assessed value for passenger vehicles boats farming equipment and trucks with a gross vehicle weight.

Pay Your Parking Violation. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year. It is estimated that by freezing the rate the city will provide Richmonders more than 8.

The 10 late payment penalty is applied December 6 th. Personal Property Taxes are billed once a year with a December 5 th due date. The county also can.

Tax amount varies by county. Personal property tax car richmond va. Local Tax Rates Tax.

Studying this recap youll get a good understanding of real property taxes in Richmond and what you should be aware of when your propertys appraised value is set. Yearly median tax in Richmond City. 074 of home value.

TAX RELIEF FOR THE ELDERLY AND DISABLED - REAL ESTATE. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. Car Tax Credit -PPTR.

Yearly median tax in Richmond City. Tax Rate per 100 of assessed value Albemarle County. The property owner must be at least 65 years of age or determined to be permanently or totally disabled by December 31 st of.

How To Reduce Virginia Income Tax

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

Henrico County Government Henriconews Twitter

Henrico County Announces Plans On Personal Property Tax Relief

The Best New Home Locations In Richmond Va Are At River City

Tax Policy In Virginia The Commonwealth Institute The Commonwealth Institute

Virginia Property Tax Calculator Smartasset

Henrico County Announces Plans On Personal Property Tax Relief

Virginia Property Tax Calculator Smartasset

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

Fillable Online Business Tangible Personal Property Tax Return City Of Richmond Fax Email Print Pdffiller

Virginia Property Tax Calculator Smartasset

Virginia Property Tax Calculator Smartasset

Youngkin Signs Bill To Reclassify Certain Vehicles And Personal Property Tax Rates Wric Abc 8news

Many Left Frustrated As Personal Property Tax Bills Increase

Personal Property Vehicle Tax City Of Alexandria Va

Many Left Frustrated As Personal Property Tax Bills Increase

What Is The Property Tax Rate In Richmond Tx Cubetoronto Com